Dexible

Strengths and Weaknesses

+ Strengths

- Similar trading orders as CEX.

- The platform is easy to use.

- Quality team of developers.

- The platform is secured.

- No KYC required.

- Up to 7 EVM blockchains.

- Integrated with more than 60 DEXs.

- The platform is driven by algorithms.

- Permissionless use.

- Weaknesses

- The project has weaker marketing.

- The Dexible team is made up of a few members.

- The ToS states that users on the platform cannot use VPNs.

- Beginners need enough know-how to use.

- Risks with participating in DeFi.

Basic Information

Dexible is a non-custodial trading engine for retail and institutional traders, designed to maximize profitability, to provide the best possible cryptocurrency trading experience in a decentralized environment. Dexible is a DEX aggregator that provides algo and automated order types commonly found in CeFi. Through Dexible, you can execute conditional & algo orders on 7 EVM blockchains and over 60 DEXs.

Upgrade to premium

Functioning of the Protocols

Dexible offers features that make DEX more flexible. It provides an automated way to allocate orders in DeFi for low liquidity assets across 7 EVM blockchains and on over 60 DEXs. Third parties can integrate the Dexible Trade Portal and Dexible Widget for free to make trading in DeFi available to their users in minutes.

On Dexible, traders can use several types of trade orders:

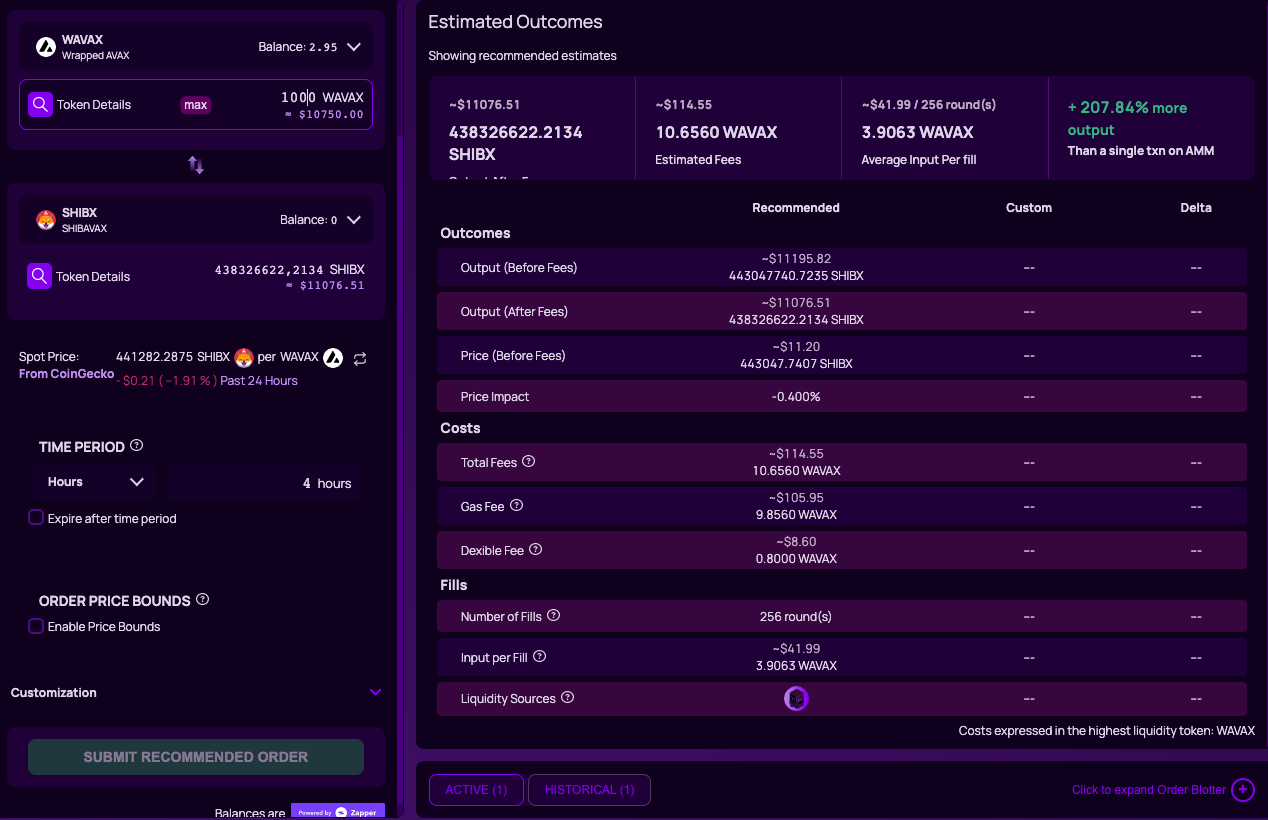

TWAP: Using the TWAP (Time Weighted Average Price) order, traders can enter or exit new positions sequentially and get an average price over a period of time. Only part of the order can be activated during a dip or peak. If traders use the "Price Bounds" feature they can set upper or lower price limit conditions independently. They can also set a time period using "Time Period" during which TWAP orders will be executed, where small values are bought at the average or lower price with breaks until the set period expires.

Segmented Order: To simplify the swapping of larger amounts of capital in an illiquid market, traders use a segmented order. Segmented orders are designed to minimize problems such as slippage and price impact, which are very common in an illiquid environment. Solving the problem of slippage and price impact is achieved by splitting orders into multiple smaller rounds over a period of time, allowing them to draw on many sources of liquidity while providing room to stabilize with other orders. When using this type of order, large orders can appear practically invisible.

Limit: With limit orders, traders can buy or sell assets at a set (limit) or better price. By entering a limit order, an input asset is exchanged for an output asset when the price of the output asset exceeds the price of the input asset.

Stop Loss: Stop loss is used by traders to preserve capital or protect profits during a price drop in the market. Stop loss orders have a trigger price at which the market order is executed.

Stop Limit: When traders want to execute a limit order in a specific price range, they use a stop limit order. A stop limit order waits until market prices reach a certain price at or above the trigger price before it becomes a limit order. The trader sets the trigger price and limit price themselves in the platform interface. The specified limit price acts as the maximum price at which he is willing to execute an exchange. The limit order is executed when the token price reaches the stopping point set by the trader.

Trailing Stop: Traders use a trailing stop order when an asset is rising so that if the market reverses, they can maintain their profits at their set percentage of the peak price. The trailing stop serves to protect profits by allowing the trade to remain open and continue to yield a profit as long as the price moves in the investor's direction. The order closes the trade if the price changes direction by a percentage set by the trader in the Dexible platform interface from the peak price.

Take Profit: The take profit order is used by traders to secure profits and avoid capital losses. A take profit order is triggered when a set percentage price threshold is crossed, which initiates a limit order that behaves like a reverse stop loss order, designed to swap assets to secure profits. Take profit works based on two price conditions, similar to a Stop Limit Order. When the price reaches the desired trigger price, it automatically sends a limit order to secure unrealized gains.

All of the mentioned commands are located on the Dexible platform in the "Cockpit" and traders can customize them independently. The "Customization" settings offer the choice of customizing the Number of Swaps, Gas Strategy, Order Expiration, and Order Slippage. If you don't want to customize your order, you just set the basic parameters of the trade order and the platform will set and calculate the recommended order outputs by itself. All calculations will be displayed in the same place where you place the order.

After placing an order, you will be able to move from the "Cockpit" to the "Order Logs" where you can keep track of your active orders and the entire history of orders already placed. Once the order is completed, it will automatically move from the "Active" orders table to the "Historical" orders table. The entire order is available here for merchants to download as a CSV file.

Trade Execution

The Dexible settlement contract handles the transaction submission. Dexible has infrastructure handling sizing and timing. Funds don’t leave your wallet until conditions match.

Gas Fees

Dexible will properly estimate the gas fee for successful strategy execution. The gas fee, computed off-chain, will be expressed in both fee-token and native currency units. Because it's computed off-chain, the accuracy of the estimate may not align with actual gas fees on-chain. Sometimes it will be higher; sometimes lower.

Swapping Fees

The business model is simple—8 basis points fee per parent order, charged sequentially for each child order transaction.

8bps means 0.08%.

ex: for a $10000 order of 8 rounds, that's $8 total, where each transaction costs $1.

Dexible offers trading orders as we know them from centralized exchanges (CEX). Everything is controlled by algorithms without the involvement of a third party they have to trust. These features have opened the door in decentralized finance to both retail and institutional traders, allowing them to enjoy trading on DEX without having to provide their personal information to a third party. To start trading on Dexible, all you need to do is connect your web3 wallet where you have enough of the necessary assets to execute orders.

Governance

There is currently no governance at Dexible, the Dexible team is currently in control of deciding on the future development of the protocol.

Over the next few months, they plan to involve the community in the decision-making process.

Dexible does not have a governance token.

Revenue and Tokenomics

Dexible generates revenue from fees. They charge 8bps on every order. 8bps means 0.08%.

ex: for a $10 000 order of 8 rounds, that's $8 total, where each transaction costs $1.

Dexible does not have a governance token.

The Uniqueness of the Protocol

Dexible makes DEXs more flexible. It provides an automated way to distribute orders for low liquidity assets across different DEXs. Flexible orders allow retail traders as well as whales and various funds to trade in a decentralized world because it solves smart swap execution. Traders can use trade orders similar to those we are familiar with from CEX.

Development History

Before the Dexible team started its work on the development of Dexible, they were involved in several major hackathon projects and launched various products.

The Dexible team first met at the Conensys Grants 2019 hackathon, where they created a proxy-contract CLI and frontend interface for Truffle work environments.

The team also created a sim-swap protection mechanism called SafeNet at ETH Denver 2020, deploying an early roll-up from Off Chain Labs.

Additionally, one of the Dexible team members was involved in the launch of The DALP (Decentralized Autonomous Liquidity Provider) at Hackmoney 2020, the precursor to APY.finance.

In November 2019, the team launched the first version of BUIDLHub, the earliest IFTTT engine for Web 3.0 <> Web 2.0 and blockchain automation.

BUIDLHub laid the foundation for the signals engine, which has become the keystone on which Dexible operates. BUIDLHub is currently freely available and powers smart integrations for - Do it Yourselfers, blockchain developers, and for contract-based state change notifications. The team has learned through relationships with key users that automation based on smart contracts is a grand vision.

Still, in 2020, the Dexible team was modifying the portfolio rebalancing tools, and automating updates to the integrated DEX. Dexible is a comprehensive and clear one-stop product for anyone executing smart swaps of any volume.

In the initial phase, Dexible only integrated liquidity from Uniswap. Gradually, it added more DEXes and today it integrates liquidity from over 60 different DEXs across the 7 EVM blockchains where it provides its trading services.

Road Map

The road map is currently internal only for Dexible team members.

Dexible team will be revamping Order Logs with a chart that shows the effective price rate of each fill versus current spot market prices in near future.

Impact

Dexible has the potential to benefit both the blockchains on which it runs and the integrated DEX from which it draws liquidity. It offers features similar to trading on CEX, which is exactly what retail and institutional investors alike are looking for. This may cause an increase in users/traders on the individual blockchains in DeFi where Dexible can be used.

Team

Michael Coon: He has been a full-stack engineer for more than 20 years. After leaving his previous position, he dove into the web3 world, where he launched the first Tellor miner and a robust smart contract platform. Later teamed up with Mitchell and Mike when they decided to capitalize on their experience and started working on Dexible.

Mitchell Opatowsky: Co-founder of Dexible serving as a senior product and marketing executive. He originally worked on crypto projects like Coinscore and the NFT game CryptoPets.

Mike Powers: Senior DevOps engineer with over 17 years of experience. He started working on infrastructure nodes in 2017 and switched to a full-time career in this sector in 2020.

Jake Tantleff: At Dexible, he serves as Director of Sales. Jake has a lot of experience from his previous roles that he uses at Dexible today.

Matt Rivas: Blockchain engineer who is credited with Dexible's fantastic routing logic.

Adebayo Daramola: Frontend engineer from Nigeria. He met Michael and Mitchell during the Hackmoney hackathon in 2021. Since then, he has become an integral part of the Dexible team.

Raphael Pinto: Full-stack developer from France who, like Adebayo, met Michael and Mitchell at the Hackenton Hackmoney in 2021. He works on UI fixes and improvements at Dexible.

Michael, Mitchell, and Mike have years of experience from their previous jobs, later each of them was fascinated by the cryptocurrency world, in which they invested all their time to fully understand the infrastructure of this sector. Starting in 2020, their time and experience will be invested along with the rest of the team to develop and improve Dexible.

Community and Marketing

The Dexible community is not very active. There are less than 300 members on Discord and the Dixible Twitter account has just over 1600 followers. Anyway, even the few active members try to create a friendly atmosphere on the discord and help the Dexible team to improve the app. For every question asked by a team member on their discord, you will get a very apt and friendly answer, but sometimes you have to wait a long time for it.

Investors and Partners

Partnerships could be considered collaborations with the blockchains on which Dexible operates i.e. Ethereum, Polygon, Avalanche, BNB Chain, Fantom, Arbitrum, and Optimism. In addition, Dexible has no other partnerships at the time of writing.

Dexible's investors include Arrington XRP Capital, Blacktower, and Decentral Park Capital.

Risks and Decentralization

As an application in DeFi, Dexible is at risk of smart contract errors and potential hacking attacks. It is important that users thoroughly research and understand the risks before using the platform.

The Dexible team is currently in control of deciding on the future development of the protocol and is still working on making the platform community-managed, but in any case, they promise that this will happen in the long run. That means at this moment the protocol decentralization is at a low level. Dexible is designed to be permissionless. To use the Dexible platform, users do not need KYC.

Protocol Security and Audits

As part of the Dexible team, two of the lead engineers are ex-NSA engineers, so needless to say they have their stuff under control. Dexible's contracts have also been audited:

Audit Solidified

KYC: They don't have.

2022 BUIDLHub Co. All rights reserved.

Analyst Opinion

A DEX with the features Dexible offers is much needed in DeFi. It offers traders an interface similar to a centralized exchange, but with the difference that everything is controlled by algorithms, with no need to trust any overarching financial institution. Dexible has a lot of liquidity that it draws from DEXs across the blockchains it runs on, so even large orders don't usually give it problems and are only affected by minimal slippage and price impact. The project is still relatively unknown, but the moment the Dexible team works more on marketing this may change quickly, as many traders are looking for a trading environment just like the one Dexible offers.

Previous

Next

.webp)

.png)

.png)

Social Networks

dexible

dexible team

dexible introducing

dexible blog

dexible gitbook