Ref Finance

Strengths and Weaknesses

+ Strengths

- The platform is easy to use

- Experienced team

- The platform is secured

- Auto router & multi-chain router swaps

- The platform is driven by algorithms

- Weaknesses

- Risks with participating in DeFi

- Beginners need enough know-how to use

- Impermanent loss in pools

Basic Information

Ref Finance is an automated market maker (AMM) decentralized exchange (DEX) built on the NEAR Protocol. The NEAR Protocol provides low transaction fees and high-speed transactions that are typically processed within two seconds. It takes advantage of the WebAssembly-based runtime, where developers use the Rust programming language.

Upgrade to premium

Functioning of the Protocols

Ref Finance is an open-source software, inspired by Uniswap v2 and Curve Finance. It works on the AMM principle. The platform is completely permissionless and the need to trust various middlemen is removed from the functioning. Anyone can participate in cryptocurrency trading or liquidity providing.

Users of the platform are divided into five different types: traders, liquidity providers, stakers, voters, and developers.

Trading

Ref Finance provides a friendly interface for cryptocurrency swapping.

Users have a choice of three cryptocurrency-swapping features:

1.Swap

The required liquidity for swaps comes from liquidity providers on Ref Finance who have created LPs for a particular pair. Traders pay a swap fee on Ref Finance, 80% of which is collected by the liquidity providers.

2. XSwap (multi-chain aggregator)

A multi-chain router, also called a multi-chain aggregator, is a built-in feature in Ref Finance that aggregates data across decentralized exchanges on the Aurora blockchain and NEAR Protocol. With this feature, traders get better prices and availability of individual assets, deeper liquidity, lower price impact, and less negative slippage.

XSwap works as follows:

- Query trading data (price, slippage, fee, etc.) on Aurora using Aurora’s Software Development Kits (SDKs)

- Find the optimal route (best price) for a specified amount of token A to token B across all liquidity pools on NEAR and Aurora

- Swap - an action that combines:

- transfer of tokens to a mapping address on Aurora via a cross-network contract call

- swap on Aurora using the user’s NEAR account keys

- transfer of tokens from the mapping address on Aurora to the user’s NEAR Wallet

2. Limit Order

With limit orders, traders can buy or sell assets at a set limit or better price. By entering a limit order, an input asset is exchanged for an output asset when the price of the output asset exceeds the price of the input asset. Limit strategies are only enabled on Ref Finance within the v2 pools $USDC.e - $NEAR, $ETH - $USDC.e, and $AURORA - $USDC.e.

Auto Router

When swaps on Ref Finance incorporate auto-router, also known as smart routing, this can be defined as the ability to find better prices for traders on Ref Finance. This involves splitting a trade into multiple pools at once. The auto-router is tasked with finding the best prices for traders across pools on the Ref Finance platform. Auto-router provides benefits to both traders and liquidity providers.

Pools

Ref Finance charges an individually customizable fee for all trades. The fee depends on the pool fee, which is set by the liquidity providers when the pool is created and cannot be changed once the pool is created. The pool fee typically ranges from 0.05 % to 0.3 %.

A liquidity pool is composed of two or three tokens; e.g., $NEAR and $REF. Liquidity pools provide the necessary liquidity for trading between cryptocurrencies.

Liquidity pools are fully permissionless, which means that anyone can freely trade, create or remove LPs.

The APR of individual pools is the revenue that the liquidity aggregators receive after they create the LP. For all trades in a pair, users receive 80 % of the fee, in proportion to their liquidity in the pool. The fees earned are automatically added to the pools. All liquidity pools have the same fee structure, as shown in the image.

Farming, or Yield Farming, is defined as the process of adding LP tokens into a farm to earn additional rewards on top of the existing swap fee income. All farms on Ref Finance are contained in one contract (v2.ref-farming.near). One farm can provide up to 16 different reward tokens.

The xREF is the main staking contract (xtoken.ref-finance.near) on the Ref Finance platform. By staking a $REF token, you exchange your $REF for $xREF. Over time, you will always earn more $REF by holding $xREF tokens. Each swap executed on Ref Finance generates revenue for the protocol, which is used to buy back $REF tokens as follows:

75 % is transferred to the xREF contract (xtoken.ref-finance.near) and released linearly over time.

25 % will be allocated to the community / provision treasury. This treasury will be used to fund grants and other community initiatives / programs.

The auto-router and multi-chain aggregator features provide traders with better pricing on smaller swaps, but in the current Bear market (Jan 2023), when most of the liquidity from the NEAR Protocol has disappeared, they cannot ensure that traders who want to conduct transactions in the tens of thousands of USD will avoid high price impact.

Governance

Ref Finance expects that in the long term, it will be fully community driven. The current DAO (ref-finance.sputnik-dao.near) uses the SputnikDAO contract to manage its affairs.

The DAO has two distinct roles - Council and Community:

Council: Council members can make proposals and vote. Only council members can create new proposals. Subsequently, other council members can confirm or reject the proposal, and this decision will remain in effect.

Community: Once a proposal has been created and approved, community members can then get involved and vote on them. The decision will remain in effect as decided by the community. For most proposals, the council will adhere to the community's decision and abstain from voting.

In addition to the Sputnik DAO information mentioned above, veToken holders can also participate in key proposals on protocol management.

The Governance Token of Ref Finance is $REF.

Usage of the $REF token:

- Protocol Revenue: users who stack $REF tokens to receive fees generated by the protocol

- Providing liquidity: users who provide liquidity with any pairs of $REF tokens earn exchange fees from their pools

- Farming: users who deposit their LP tokens into various farms, earn additional revenue

- Governance: users who create LP $REF<>$NEAR can earn veTokens that can be used to vote on proposals related to protocol governance

Revenue and Tokenomics

Revenue

Ref Finance generates revenue from swap fees only, and most of the revenue is distributed back to $xRef stakers.

Tokenomics

The total supply of $REF tokens is limited to 100 000 000 tokens and there are currently 22 123 941 $REF tokens in circulation.

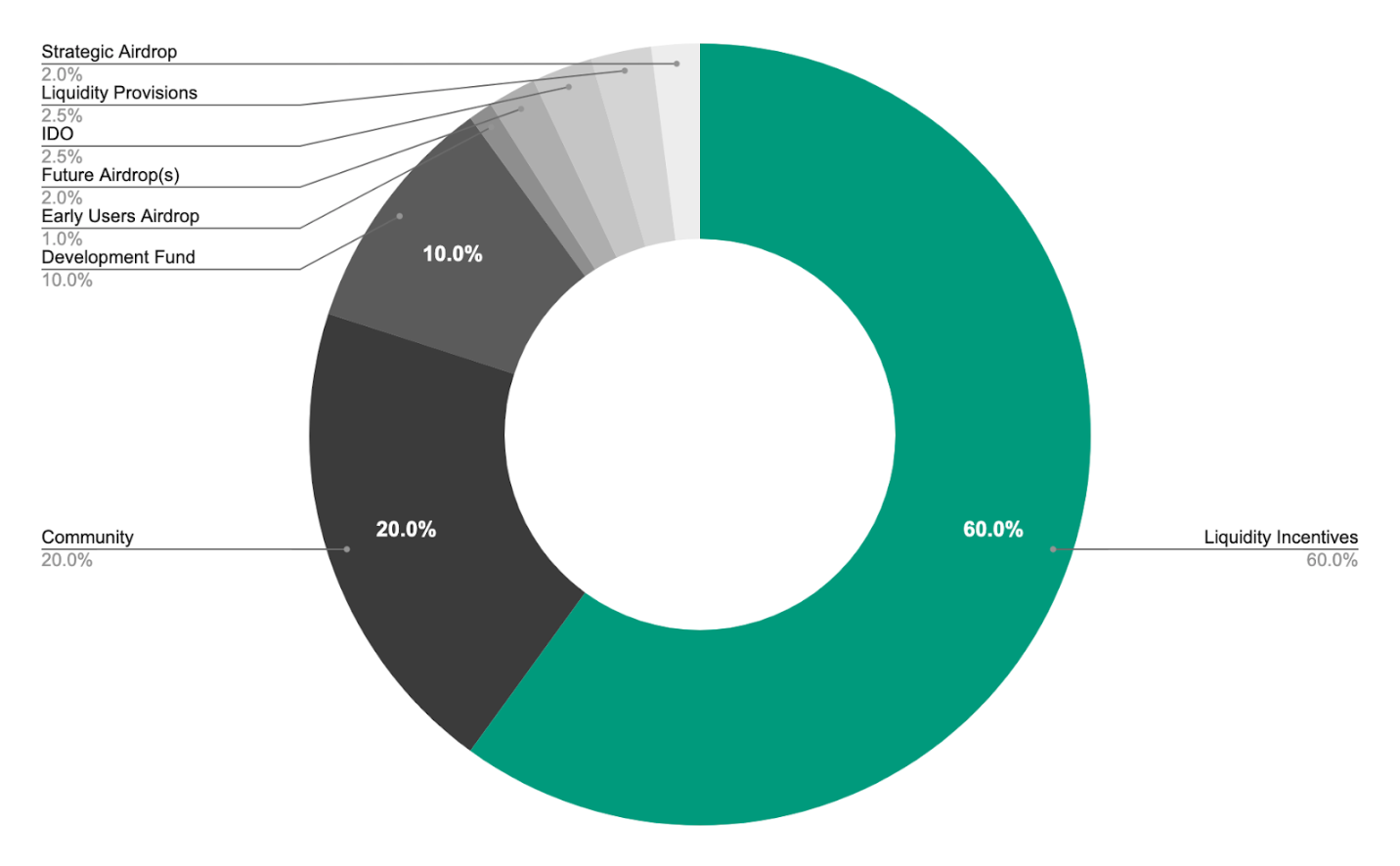

The initial distribution of $REF tokens was as follows:

Liquidity Incentives: 60 %, with the following release: Year 1: 25 %, Year 2: 18.3 %, Year 3: 11.7 %, Year 4: 5 %

Treasury: 20 %

Development Fund: 10 %, with a 4-year linear release

Early Users Airdrop: 1 %, with 3-month vesting and a 3-month cliff

Future Airdrop(s): 2 %

IDO (Skyward Auction): 2.5 %, with a 1-week auction

REF Token Liquidity Provisions: 2.5 %

Strategic Airdrop: 2 %

In March 2022, Ref Finance closed a strategic over-the-counter transaction with professional investors. The list of investors can be found in the article below.

The goal of the fundraising is to support and cover development and solution costs for at least 24 months, starting in March 2022. The total amount raised was 4.5 million USD in stablecoins, in exchange for 3 664 943 $REF tokens, resulting in an average price of 1.227 $REF per stablecoin. The stablecoin distribution of the amount raised was as follows: 3.6 million $USDC, 0.9 million $USDT.

Terms for this fundraising were a 7-day market Time-weighted Average Price (TWAP) at a 20 % discount and lockup for a 1-year linear release every quarter.

Centralized exchange (CEX) listing $REF: gate.io, MEXC, CoinEx, BingX, Jubi.

Cliff indicates the period that must elapse before the token release begins.

The Uniqueness of the Protocol

Ref Finance benefits from being built on the NEAR Protocol, which provides low fees and transaction finalization in one to two seconds. Multiple liquidity pools are contained in a single contract and traders can source liquidity from multiple pools in a single transaction thanks to auto-router functionality. Pools with the highest liquidity and lowest swap fees are prioritized for transaction execution.

Ref Finance was created by NEAR Protocol co-founder, Illia Polosukhin, and provides various incentives for dApp developers, giving them the incentive to build projects on top of Ref Finance. Ref Finance has a significant lead in TVL over other protocols built on top of the NEAR Protocol, which is why it is still the number-one choice for traders and liquidity providers.

Development History

Ref Finance was initially created by Illia Polosukhin, co-founder of NEAR Protocol. The first commit on GitHub was made on March 9, 2021.

Following the deployment of the application in April 2021, Proximity Labs, a research and development company focused on NEAR, received a grant from the NEAR Foundation to bootstrap and scale Ref Finance.

In Early June 2021, Proximity set up the Ref Finance DAO. DAO members were selected based on their value, contribution, and activity across the board (mainly Telegram and Discord).

Early well-known contributors were:

Developers

Illia

Evgeny

Marco

Joe

Referencedev

Mikedotexe

Business, Strategy, and Product

ve$RUST at Proximity Labs (ex-NEAR core team)

Kendall at Proximity Labs (ex-NEAR core team)

Since the launch, Ref Finance has been backed by powerful names from NEAR Protocol, and the developers are constantly innovating and adding new features to the platform's functionality. I have tried many strategies on Ref Finance, which I have written about in Ref Finance - Opportunities & Risks. If the team continues at the current pace of development while NEAR Protocol continues to succeed in the future, Ref Finance is very well positioned to be the number one DEX on the NEAR Protocol.

Road Map

For information on the Q4 2022 report and the outlook for Q1 2023, you can listen to the Ref Finance Twitter Space AMA here.

Ref Finance 2023 Road Map is live!

Impact

Ref Finance gained popularity in its early days, which placed it at number one in the TVL locked on NEAR Protocols. The protocol provides traders and investors with functions for swapping and interest-earning cryptocurrency in one place. The developers are active, always trying to come up with new features which attract new users to the ecosystem. Ref Finance is the main source of liquidity on NEAR Protocols. A feature for multi-chain swaps connects NEAR and Aurora, where liquidity is also sourced from DEX Trisolaris and 1inch on the Aurora blockchain.

Team

The Ref Finance Team is a mix of pseudonymous and non-pseudonymous people. It consists of fifteen full-time members who are paid by the Dev DAO (dao.ref-dev-team.near).

Marco (Lead Backend Developer), Joe (Lead Frontend Developer), Gordon (Senior Backend Developer), ZQ (Senior Fullstack Dev), Dom (DevOps), Max (Frontend Developer), Nature (Frontend Developer), Willa (Lead QA Engineer), Amy (QA Engineer), Mency (Designer & UX), Didier (Product Manager), Harry (Assistant Product Manager), San (Lead Business Development), Fay (Researcher Analyst), Ray (Researcher Analyst), and Fauve (Lead Marketing).

We have only mentioned team members who are working full-time on the project. In addition, there are others involved in the project, although they are not considered full-time members. There is also a Proximity Labs ve$RUST member working on Ref Finance, who is one of the project leads involved in product design, sales, marketing, and growth. As the project is community-driven, the team is made up partly of its many members who regularly contribute to various aspects of the project, as well as moderators who are in control of the community communication channels.

Community and Marketing

Ref Finance makes it clear that all are welcome in their community, regardless of age, gender or gender reassignment, disability, race, nationality, religion, or sexual orientation. The developers and team members strive to provide the community with the best possible conditions and a friendly environment. They have almost 80 000 followers on Twitter, but only a few of them are active, compared with the previous Bull market, when the activity was many times higher. The same is the case on Discord, where users are not very active (January 2023). Nevertheless, for every question asked by a team member on their Discord, you will get an appropriate, friendly answer.

Ref Finance takes a lot of care over their marketing and present themselves regularly with Twitter posts and a weekly Twitter Space AMA, during which they discuss the protocol with users. They have also established various collaborations. Admittedly, in today's market (Jan 2023), they are not getting the rewards they deserve, but I believe that if they keep up this pace of marketing, particularly when the positive sentiment returns to DeFi, it will all pay off for the protocol.

Investors and Partners

Ref Finance's investors include Jump Crypto, Alameda Research, Dragonfly Capital, D1 Ventures, OKX BlockDream Ventures, Kucoin Ventures, SevenX Ventures, Woo Network, Move Capital, and Puzzle Ventures.

Ref. finance has partnerships with NEAR blockchain, Stader labs, WOO Network, LiNEAR Protocol, and others.

Risks and Decentralization

In DeFi, we know about the many risks associated with issues in smart contracts or potential hacks that can cause users to lose their invested funds.

Ref Finance is a community-led DeFi platform with a high level of decentralization. The Ref exchange contract is designed to be permissionless, meaning anyone can create a pool for any two tokens. To use the Ref Finance platform, users do not need KYC.

Protocol Security and Audits

Guardians

Guardians serve to suspend the protocol in the event of a critical error or attempted misuse, etc. Guardians exist to mitigate risks and potential loss of funds.

Guardians are defined as specific NEAR addresses that have the ability to pause the main contract (v2.ref-finance.near). Each guardian must know how to work with the Command Line Interface (CLI). They are the key participants in failover security, who can respond in the event of a specific type of failure. These events are defined but not limited: An attack or exploit in progress, a critical vulnerability identified in production, or deployment causing a potential security vulnerability. In practice, the way this works is that the guardian identifies the potential threat that would require the contract to be paused (v2.ref-finance.near) and thoroughly checks all the facts. They then inform the other guardians and together, they pause the contract. After this has been done, they inform the team members, the DAO, and the community. Once a solution is found, the reactivation of the contract will follow, which can only be done by its owner (v2.ref-finance.near).

Audit Reports:

Audit by Jita

Date: February - June 2022

Audit by BlockSec

Date: June - December 2022

Ref v2 (Concentrated Liquidity) report

Bug Bounty

Full details of the program and payouts for bugs detected can be found here. Payouts are made in $USDT, $USDC, $NEAR, $wNEAR, or $REF, at the discretion of the Ref Finance team.

KYC: None.

Analyst Opinion

If you've read this far, you've learned plenty of details about how the Ref Finance protocol functions, its advantages and disadvantages, the functioning of governance, the security of the platform, and much more. Ref Finance provides users with a decentralized environment for cryptocurrency trading and interest. It is important to always think about choosing the right strategy for you, which we have written more about in Ref Finance - Opportunities & Risks.

Ref Finance is well on its way. As the main DEX of the NEAR Protocol, it supplies adequate liquidity for cryptocurrency swaps. The platform has a high level of decentralization and its future is decided by users in governance votes. Ref Finance is backed by a responsible team and quality developers, with a friendly approach that only adds to its qualities. My opinion of Ref Finance is positive and I am very curious to see how they continue on their journey.

Decentralized applications are still vulnerable despite auditing companies' controls, and it may be that a hacker will figure out a bug in the code before these companies, or the developers themselves. In the event of a hacker attack, users may lose their invested digital assets, which can significantly affect overall motivation to continue investing money and time in DeFi. Always be prepared to accept a certain level of risk and diversify your investments wisely.

Previous

Next

.webp)

.png)

.png)

Social Networks

ref finance

crunchbase

awesomenear