.png)

Arbitrum

Latest News

Strengths and Weaknesses

Strengths

- Cheap transaction fees – for a fast transaction you will pay 0.3 GWEI (= 0.0000000003 $ETH) and for a slow transaction you will pay 0.1 GWEI (as of 8 Jan 2023)

- Fast transactions – Arbitrum can process up to 40 000 transactions per second

- EVM compatibility – developing and migrating dApps to Layer 2 is easier and more efficient with EVM compatibility (developers don't have to learn a new programming language)

Weaknesses

- Ethereum 2.0 – due to the launch of the Ethereum blockchain on PoS, Arbitrum may become less popular

- 7-day waiting period – in the case of sending funds from Arbitrum to Ethereum, you will have to wait 7 days for the transaction to be confirmed (for security reasons)

- Centralization – Offchain Labs is responsible for running all sequencers and determining the project's future direction

Basic Information

Arbitrum operates on a Proof of Stake (PoS) consensus shared with the Ethereum blockchain.

Arbitrum was created to improve Layer 2 (L2) of the Ethereum blockchain in terms of scaling speed and to provide additional privacy features.

Arbitrum is compatible with the Ethereum Virtual Machine (EVM), making it possible to convert Ethereum blockchain applications to Layer 2 applications without having to modify them.

Using "Transaction Rollups," the L2 transactions are processed and sent in bulk to the Layer 1 (L1) of the Ethereum blockchain for finalization.

Arbitrum was developed by Offchain Labs, a New York-based company. Its founders are Ed Felten, Steven Goldfeder and Harry Kalodner.

Upgrade to premium

Functioning of the Chain

Arbitrum uses ArbOS to run the blockchain. This system provides cross-chain communication, layer 2 fee economics and blockchain administration.

Arbitrum Virtual Machine (AVM)

The Arbitrum team has created a custom VM that is compatible with the EVM. Since transactions are performed at Layer 2, the environment had to be modified to be compatible with decentralized applications (dApps) running at Layer 1.

One of the main differences between AVM and EVM is the usage of "code points." Normally, during code execution, instructions are stored in a linear array with a program counter (PC) that points to the current instruction. Using a program counter to show which instruction is currently being executed would take a long time. To reduce this time, the Arbitrum team implemented code points as a pair: the current instructions and the hash of the subsequent code point. Each instruction in the array has its own code point. This allows AVM to immediately prove which instruction was executed on a given program counter. Code points do indeed add some complexity to AVM, but the Arbitrum blockchain only uses them when it needs to perform proof of transaction. Otherwise, it uses a conventional program counter architecture.

Arbitrum was upgraded in August 2022 to its system called Nitro. Let’s discuss its new features:

- Sequencing and subsequent deterministic execution

- Geth built into the core

- Separate execution and checking of transactions

- Optimistic Rollup with interactive Fraud Proofs

Sequencing and subsequent deterministic execution

The user sends the transaction to the sequencer after creating it. Sequencers receive transactions, sort them into sequences, and publish them.

During the checkout process, the sequenced transactions are checked one by one (account balances, contract codes, etc.). Once a sufficient number of transactions have been checked, the compressed transactions are sent to layer 1 for finalization.

The state transition function is deterministic, which means that it only depends on the current state and the next transaction – and nothing else. Due to this determinism, the outcome of a transaction T depends only on the state of the genesis chain, the transactions preceding T in the sequence, and the transaction itself.

Anyone who knows the sequence of transactions will be able to determine the previous state. The Nitro nodes function in this manner (they receive the sequence of transactions and create additional blocks).

A deterministic algorithm is an algorithm that always produces the same results (so that it is predictable) from the same initial conditions (input).

Geth built into the core

The 'Geth' refers to the 'go-ethereum' application, which is one of the most common node management software used in Ethereum's network.

The Go-Ethereum program is written in the GO programming language, as is the entire Nitro.

- A node's functionality includes handling connections and requests from clients, as well as providing other top-level functions for operating an Ethereum blockchain-compatible node

- ArbOS is a custom software designed for the Arbitrum blockchain that ensures the smooth operation of Layer 2

- Geth core is the core of the Geth system that emulates the operation of Ethereum smart contracts and maintains the data structures that maintain the Ethereum blockchain state (Nitro is presented as a software library in this code with a few minor modifications that add necessary improvements).

Separate execution and checking of transactions

The Nitro uses the same source code for both execution and checking, but they are used in different ways:

- Execution uses the Go compiler to produce native code for the target architecture, which will of course vary for different nodes

- The Go compiler compiles a section of the code into WebAssembly (WASM), which is a typed machine code format. After a simple transformation is performed on the WASM code, we are left with a format we call WAVM. In the event of a dispute regarding the correct result of a determination, WAVM will resolve the matter.

Optimistic Rollup with interactive Fraud Proofs

Optimistic Rollup

Arbitrum uses rollups, which means that all transactional data on the Arbitrum blockchain (Layer 2) is passed to Layer 1 as an aggregate of blocks, which are then recorded on the Ethereum blockchain. The information provided here allows everyone to determine the current correct state of the blockchain. The entire transaction history of the blockchain is available, so that the state of the blockchain can be reconstructed using only publicly available data if necessary.

Arbitrum (like its L2 competitor Optimism blockchain) is "optimistic", meaning that Arbitrum creates blocks (rollups) of its blockchain by allowing anyone (the validator) to publish on layer 1 a block from the rollup they claim is correct, and then allowing everyone else to challenge it. Upon expiration of the challenge period of 7 days (valid as of January 2023) and no one challenges the declared block from the rollup, Arbitrum will confirm the block summary as accurate. Arbitrum will use a system of fraud proofs to determine which party is cheating if anyone disputes the claim within the deadline – interestingly, competitor Optimism has renamed them "fault proofs" because of the negative connotation. If cheating is confirmed, the cheater will lose his deposit, which will be divided between the person who reported it and part of it will be burned.

Interactive Fraud Proofs

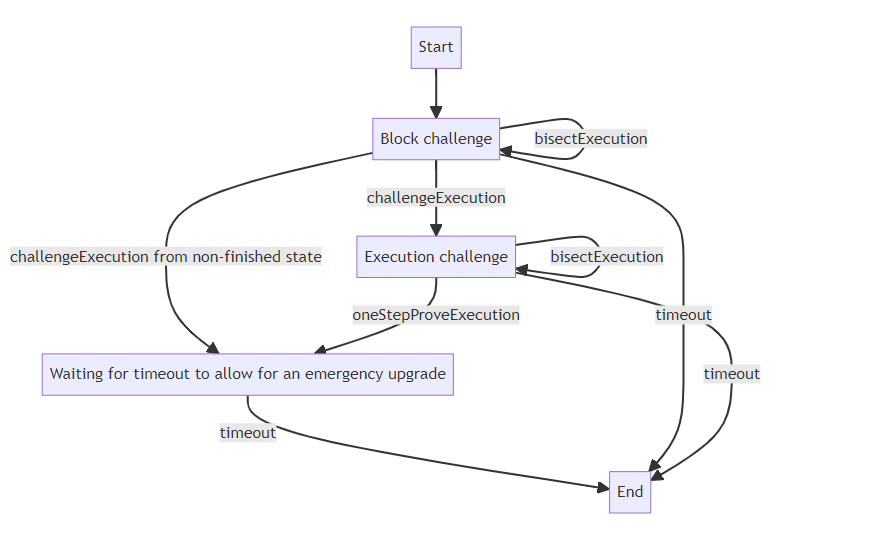

As the proof of possible fraud is handled by a mechanism called ChallengeManager, it follows the following steps: the block challenge, the execution challenge, the general bisection protocol (general interval halving protocol), and the winning challenge (decision on who wins the challenge).

- Block challenge: Initially, the challenge is divided into two parts based on global states (including block hashes). Once the dispute has been narrowed down to individual blocks, the challenger can invoke the next step: the execution challenge, to begin the process of verification.

- Execution challenge: The actual proof can be divided once the blocks have been narrowed down to single blocks. Once the proving has been divided into steps, the challenger can invoke oneStepProveExecution. Data must be provided as proof of fraud by the actual challenger. In the event that the data provided by the challenger proves to be accurate, the challenger wins.

- General bisection protocol: During each round of the "game," the current challenger is required to challenge two adjacent sections. Specifically, he challenges his opponent's claim, executes the first section for a specified period of time (number of steps), and then creates the second section. At this point, both parties agree that the first section is correct, but disagree about the second section. The respondents are required to submit a bisection with a starting section that is identical to the first section, but with an ending section that differs from the second section. As a result, the problem is divided into smaller time periods, and now it is his opponent's turn to solve the problem. In order to ensure that the task progresses, each bisection must have a degree that corresponds to min (40, numStepsInChallengedSegment). Furthermore, bisections of length onesection cannot be divided. It depends on the challenge phase what gets executed, either challengeExecution or oneStepProveExecution. The sectioning is symmetrical, with each participant taking turns selecting which section to mark for subsequent inspection.

- Winning challenge: The process of winning a challenge is not instantaneous. As a result, the current challenger is declared the winner and the hash is set to 0. When the time limit expires, the side will lose since it has no valid moves. It is done as a precaution to ensure that if the challenge is resolved incorrectly, an update of the contract will allow time to diagnose and correct the error.

Development History

2018

- Founding of Offchain Labs by Ed Felten, Steven Goldfeder and Harry Kalodner in New York

2019

- Offchain Labs has raised 3.7 million USD from Block Nation, Coinbase Ventures, Compound, Jake Seid and Pantera Capital

2020

- In February, the testnet for Arbitrum was launched

2021

- This year, Offchain Labs raised 220 million USD from Alameda Research, Lightspeed Venture Partners, Mark Cuban, Pantera Capital, Polychain Capital, Redpoint Ventures, Ribbit Capital and others

- In August, the Arbitrum mainnet was launched

2022

- In June, the Arbitrum Odyssey project was launched to promote the entire blockchain

- In August, Nitro was updated on the Arbitrum blockchain

2023

- In March, Arbitrum launched an airdrop of its coin, ARB.

Arbitrum Odyssey

The purpose of this project was to promote the Arbitrum blockchain. This program was intended to last for 8 weeks, and you were rewarded with NFT after completing certain tasks. In the first week, over 140,000 users participated, and the onslaught of transactions was so overwhelming (280,000 transactions per day) that the blockchain slowed down and fees jumped to 6 USD on June 27, 2022. On the Ethereum blockchain, however, the fee was 5 USD that day.

Due to blockchain congestion and the long-term unsustainability of such a volume of transactions, Offchain Labs had to postpone the Odyssey project. In order to address the scaling issue, the team promised to resume the Odyssey project work where it left off after the Nitro update.

After the Nitro update, the Arbitrum network is capable of handling much higher transaction volumes without any issues. By the end of 2022, the network was able to process up to approximately 580,000 transactions per day without any major problems.

Team

Edward William Felten

Professor of Computer Science and Public Affairs at Princeton University, where he served from 2007 to 2015. He was appointed Chief Technologist of the Federal Trade Commission in November 2010 and officially assumed the position in January 2011.

In 2015, he was appointed as the United States' Deputy Chief Technology Officer.

He returned to Princeton University from 2017 to 2019 to serve as Director of the Center for Information Technology Policy.

He has also conducted extensive research in the field of computer security - he is a great admirer of the field of cryptography.

Steven Goldfeder

He studied at Princeton University. He is a postdoctoral fellow at Cornell Technical University. Among his research interests are cryptography, security, and privacy, particularly in the context of decentralized digital currencies.

Harry Kalodner

During his PhD studies at Princeton University, he studied the economics, anonymity, and compatibility of cryptocurrencies.

Governance

ARB is the governance coin used to manage the Arbitrum blockchain. Its primary use is to vote on new proposals that are being made within the Arbitrum DAO. Anyone who owns at least 5,000,000 ARB can submit a proposal to the Arbitrum DAO. If you do not have enough ARB, you can allocate your coins to a delegate, who will create a proposal on your behalf. You can vote and submit proposals here.

Delegates are elected to represent other ARB holders and can vote and create proposals on behalf of the entire community.

The security council is responsible for the proper functioning of the DAO. The council consists of 12 members who are elected every six months through a democratic process involving DAO members. They are responsible for addressing risks to the Arbitrum ecosystem. Candidates must be DAO members and have the support of at least 0.2% of all eligible coins. Elections are governed by rules and procedures that are established by the Arbitrum Foundation. Candidates must not have conflicts of interest, and no more than three candidates from the same organization should be elected to the council. Council members can be removed by DAO members, but this requires a minimum quorum to be successful. If there are inconsistencies between the constitution and other DAO documents, the constitution takes precedence.

The total number of ARB in circulation is now 1,275,000,000 ARB, with the first 50 wallets owning approximately 44%. Currently, ARB is a relatively new coin in circulation after an airdrop, so it will be interesting to see how it is distributed among other users over time as more coins come into circulation.

Arbitrum DAO presented one of the first proposals, AIP-1, which included the distribution of 750 million ARB. This would not be a bad thing if the community had decided on it. Unfortunately, Arbitrum DAO sold 10 million ARB before the vote was over, before the community noticed and caused a stir.

Arbitrum then issued a statement attempting to explain their actions, however, it strikes me as odd that they are trying to behave in a decentralized manner. To be more transparent and decentralized either they could have waited for the end of the vote, or only submit a proposal for the necessary amount of ARB for Offchain Labs, as their explanation suggests. This has significantly reduced my trust in the project.

Revenue & Tokenomics

The main revenue stream for Arbitrum comes from network fees, and in the future, it looks like it will also come from questionable manipulations with DAOs.

The initial distribution of 1.27 billion ARB coins was divided as follows:

- 42.78% of the initial supply, 4.278 billion ARB, is allocated to Arbitrum DAO treasury

- 26.94% of the initial supply, 2.694 billion ARB, is allocated to Offchain Labs team and future team + advisors

- 17.53% of the initial supply, 1.753 billion ARB, is allocated to Offchain Labs investors

- 11.62% of the initial supply, 1.162 billion ARB, is allocated to users of the Arbitrum platform via airdrop to user wallet addresses

- 1.13% of the initial supply, 113 million ARB, is allocated to DAOs building apps on Arbitrum via airdrop to DAO treasury addresses. Here is a list of all the DAOs that received an airdrop

- The Offchain Labs team, future team, and advisors have their coins locked for up to 4 years. For the first year, all coins are locked, then from March 23, 2024 to March 23, 2027, the ARB coins will gradually be released

- Offchain Labs investors also have their coins locked for up to 4 years. For the first year, all coins are locked, and then from March 23, 2024 to March 23, 2027, the ARB coins will gradually be released

- The distribution of ARB in the Arbitrum DAO treasury will be decided by future voting

Currently, there are 1,275,000,000 ARB in circulation and the inflation rate is set to a maximum of 2% per year.

The Uniqueness of the Chain

Arbitrum is considered the most compatible with EVM – it is possible to use any programming language that EVM supports. The Offchain Labs team has been working hard to improve its AVM in order to minimize barriers for new developers.

Compared to Ethereum, Arbitrum has low transaction fees. This advantage is achieved through its efficient rollup technology. The fees can be kept to a minimum while maintaining a sufficient incentive for the validators.

Arbitrum and Optimism are most similar second layers (L2). Arbitrum was launched earlier than Optimism and also took longer to develop. As a result, it has a technological advantage. A good example of this would be when it comes to assessing disputes in transaction verification.

Arbitrum uses a different dispute resolution process for verifying transactions. Optimism utilizes "single-round" evidence of fraudulent transactions conducted at Layer 1, while Arbitrum utilizes evidence of fraud that is conducted entirely outside the blockchain (off-chain).

The multi-round proof of fraud attempts is more efficient and cheaper to operate. This is why Arbitrum is a safer alternative to Optimism.

How the Network is Secured

A block is created by nodes, which can be divided into validators and sequencers. As a result, they are rewarded with transaction fees. Arbitrum is designed so that one honest validator can validate a block regardless of the number of dishonest validators.

Validator nodes are assigned the following roles:

- The active validator utilizes staking (putting his or her Ethereum into the smart contract) and creates new blocks that are added to the main Ethereum blockchain. When a proposed block appears suspicious, the validator can be challenged and included in the challenge to defend the accuracy of the transaction information contained in the proposed block

- The defensive validator monitors the activity of the rollup protocol, intervening if "incorrect" blocks are detected and offering to block them or stacking its tokens onto "correct" blocks

- The guarding validator only monitors the rollup protocol without stacking

Validators have seven days to mark an incorrect block, so natively bridging assets (using a bridge) from the Arbitrum blockchain to Ethereum will take the same amount of time.

Sequencer and centralization

Rather than having one centralized server, the sequencer is distributed among multiple servers, and the sequencer determines a fair order of transactions if a supermajority of the servers are reliable.

How does the Arbitrum blockchain aim to achieve this?

Offchain Labs CEO and co-founder Steven Goldfeder led a research team at Cornell Technical University that proposed a decentralized algorithm for fair sequencing. Currently, the algorithm is in development, but it is being improved over time.

For now, all sequencers are under the control of Offchain Labs.

Nodes

Supported nodes

The Arbitrum blockchain can be interacted with using many of the same node providers as Ethereum.

Third party applications that support staking can be found here.

Advantages:

- No need for custom hardware

Custom node

To start your own node, you can find detailed instructions here.

Advantages:

- Block verification

- Fee rewards

Road Map

The Arbitrum blockchain does not have a Road Map for 2023. In the event that Offchain Labs releases one, it will be added here as soon as possible.

Offchain Labs is now focusing on enhancing the decentralization and scalability of the Ethereum blockchain.

Ecosystem

Due to its maximum compatibility with EVM and fast and cheap transactions, Arbitrum has a lot of DeFi projects.

The biggest DeFi projects on the Arbitrum blockchain:

- GMX – DEX with derivatives

- Radiant – decentralized lending

- Uniswap – DEX

Arbitrum has more than 100 active DeFi protocols, giving a total of 1.5 billion USD TVL (as of Jan 8, 2023).

Over 220 million USD has been raised by Offchain Labs in a variety of funding rounds. The funds raised will be used to grow the ecosystem and support new projects.

Community

On the official Discord server, you will find a very friendly community, there are a number of sections for developers and users, where it is possible to address a problem and receive a quick response. Regular AMAs are held by them in which you may ask questions.

There is a large following on Twitter. The Arbitrum team posts news and collaborations relevant to the development of the Arbitrum chain.

As part of their YouTube channel, they publish regular AMAs with protocols operating on the Arbitrum blockchain on a regular basis (2 to 3 videos a week).

Partners

Supported Wallets

- Ledger Nano X – the most widely used hardware wallet (HW) on the market. When paired with your SW wallet, you get more security for your cryptocurrencies.

- TrustWallet – software wallet (SW)

- MetaMask – software wallet (SW)

Analyst Opinion

Arbitrum as an L2 chain is doing its job well. After scaling issues were resolved with the Nitro upgrade, everything is now running smoothly. Their 7-day block invalidation period is the same as Optimism's and provides security guarantees.

What I don't like is the centralization of Arbitrum. It's fine that nodes become validators and create new blocks or simply verify the accuracy of information. However, the sequencer has the final say in block submission for finalization. Since Offchain Labs controls all the sequencers that manage the blockchain, transactions can be manipulated and modified according to the needs of the company. This is expected to change in the future, as with the Optimism blockchain, by deploying more sequencers that are not under the control of a single entity.

Another thing I dislike is the concept of the new coin, ARB, which was created on March 23, 2023. Many people were looking forward to this coin through a large airdrop. This also triggered the creation of the Arbitrum DAO, which will decide the future of the Arbitrum blockchain. However, their first AIP-1 failed, as Offchain Labs' key members were impatient and released 10 million ARB without a finalized vote, and this was subsequently sold. If all votes proceed like this, seemingly only for the sake of the community but still promoting their own philosophy, I believe the value of the Arbitrum blockchain will decline sharply.

In conclusion, as with all chains related to the Ethereum blockchain, layers-2 were created due to problems Ethereum had when operating on PoW. Now that Ethereum is transitioning to PoS and trying to solve its main issues, such as high fees and scaling, L2 chains may become unnecessary.

Previous

Next

.jpg)

.webp)

.png)

.png)

.png)

.png)

.png)

.webp)

.png)

.png)

.png)

.png)

.png)

Social Networks

Zerion

Coinmarketcap

Medium Coinmonks

Github

Decrypt

Buybitcoinbank

Medium

Dune

Alchemy

Official Website

Prnewswire

Alchemy

CoinCarp

TokenTerminal

Docs Arbitrum

Twitter

Tally